Agriculture is a soft spot for Vietnam

Agriculture is a soft spot for Vietnam

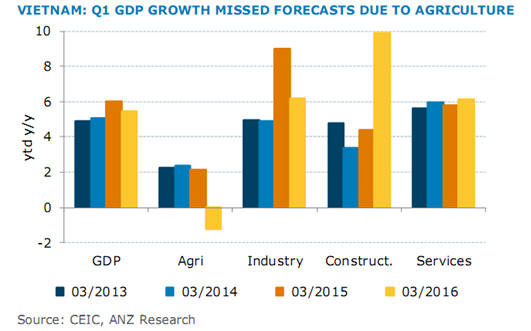

Vietnam’s first quarter growth at 5.5 per cent was a result of the reduction in agricultural output and the sector could be in for a tough year, on the back of extreme El Niño effects, according to ANZ Research.

“Though we still expect Vietnam to outperform its regional peers, we cannot singularly focus on the trade out-performance. It is not entirely surprising that some domestic risks to growth are emerging and these are primarily sprouting from the agricultural sector,” the Vietnam Q2 Update Report noted.

“Hence, we take the opportunity of this Q2 update to acknowledge downside risks to our GDP growth forecasts of 6.9 per cent in 2016 and 6.5 per cent in 2017,” noted Eugenia Victorino, ANZ Banking Group’s ASEAN and Pacific region.

So far the changes in the National Assembly have had a limited impact on economic policy and growth. Yet the incoming cabinet will likely face an uphill battle in reaching the 6.7 per cent GDP growth target set by the government. Although Q1 GDP growth fell short of ANZ and market expectations, Vietnam is still comfortably positioned to outperform its regional peers.

“The 5.5 per cent on-year expansion in the first quarter puts downside risks to our own 6.9 per cent forecast for 2016 and 6.5 per cent in 2017,” the report read.

Agricultural output, in particular, accounting for 16.1 per cent of the economy, contracted 1.2 per cent y/y in Q1. Crops have been damaged by both the early onset of the cold weather in the north and the severe draught along the Mekong delta. The outlook for agricultural exports (around 12 per cent of total) has dimmed along with expected decline in global rice production.

While food supply will likely be tighter, inflation will not necessarily surge immediately. An IMF paper (Bhattacharya, 2013) found that Vietnam shows a higher degree of persistence in inflation than other countries. This could be due to the higher proportion of the CPI basket under the price stabilisation mechanism. In any case, the slow rise of oil prices will likely cap headline inflation to average 1.7 per cent year-on-year in 2016 and 2.5 per cent in 2017.

Meanwhile, construction continued to surge 9.9 per cent y/y, the fastest Q1 expansion in more than five years. Though growth in industry eased to 6.2 per cent y/y in Q1, from 9 per cent in the same period in 2015, it provides ample support from a sector that accounts almost 30 per cent of the economy.

With regards to the external trade of goods, the trade balance swung to a narrow $776m year to date surplus. This has eased the upside pressure on the USD/VND rate, allowing the central bank to rebuild its FX reserves.

Imports declined on the back of 18 per cent y/y contraction in imports of machinery due to base effects. The surge in imports in 2015 was broadly due to the expansion of production capacity. The simultaneous decline of automobile imports in Q1 diminish the risks of consumption-led importation.

On the other hand, imports of electronics buck the trend suggesting that the growth outlook on exports of computers and phone parts remain robust. Export growth is still fighting the regional softness at 6.2 per cent y/y in Q1. However the dim outlook on agriculture will likely put a cap on total shipments, even if electronics production continues to diversify.

The much hoped for benefits from the TPP is fading as the presidential elections in the US heat up. “However, we believe the benefits from the EU-Vietnam Free Trade Agreement, if successfully ratified, opens up another market with immense opportunity. Our analysis of the textile apparel industry suggest that Vietnam has room to grow its garment and footwear exports to the EU if it is able to diversify production facilities and be present across the whole value creation chain of the industry,” the report read.